Karl N. Snow and Dr. Karl Diether, Economics

Introduction

Exchanged-based option trading began on the Chicago Board Options Exchange (CBOE) in 1973. The American Stock Exchange (AMEX) and the Philadelphia Stock Exchange started trading exchange-based options in 1975, and the Pacific Stock Exchange (PSE) and the Midwest Stock Exchange (MSE) in 1976. Exchanged-based option trading has experienced tremendous growth in both the number of options trading and the total trading volume. By 1997 there was over 2,000 underlying stocks with exchange-traded options. In 1980 the number was below 300. In 1996 the trading volume was close to 200 million contracts. This is double the volume of 1980 1. During this time of growth there have been major changes to the market structure. Many theorize that these changes are integral in explaining the growth of the option market.

Multiple Listing

Perhaps, the most dramatic change in the market structure is multiple listing. Multiple listing was tried a number of times in the 1970’s and early 80’s, but never lasted long. However in 1987 the Securities Exchange Commission (SEC) proposed multiple listing on all stocks. Newly listed options became available for multiple listing on Jan 22, 1990. However, no exchange has crosslisted an option that has already been trading on another exchange.“ The general understanding seems to be that if one exchange were to crosslist an option, the competing exchange would retaliate by crosslisting other options, leading to further retaliation and eventually an industry wide battle over multiple listing.1”

Stylized Facts

Stylized facts are generalizations about behavior. In economics and finance they serve as guidelines for the development of theory. For example, a stylized fact in macro economics is that the correlation between GDP and unemployment is negative. Any macro theory should predict such a result.

My research has been an attempt to define a stylized fact about what happens to multiply listed options over time. Does one exchange become dominant causing the non-dominant exchanges to delist the option? If this is true, the stylized fact would be: Multiply listed stocks consolidate to one exchange over time.

Data

My data is from the major option exchanges. For each option there is a listing date and a delisting date. The total number of underlying stocks that were listed on multiple exchanges is 675.

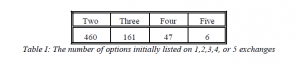

None of the six options initially listed on five exchanges were reduced to a single exchange by the start of 1997. Only one of the 47 options initially listed on four exchanges was reduced to a single of exchange. The option become listed on a single exchange after 41 months. This might not tell us much because 35 of the other options were listed for less then 41 months. In fact 30 of the options had been listed for less then two years.

Nine of 161 options initially listed on multiple exchanges were reduced to a single exchange. The average number of months until the nine were reduced to a single exchange was 24. The other 152 options were listed an average of 27 months.

Sixty-eight of the options initially listed on two exchanges were singly listed by the end of the sample period. This represents a larger proportion (.15) than the other cases, but still small. The 393 options still on 2 exchanges were on average listed for 26 months. On the other hand the average for those that were reduced to a single exchange was 15 months.

There is no pattern of consolidation to a single exchange over time. In fact, really very few of multiply listed options consolidated to a single firm. The best way to describe the stylized fact is: multiply listed options tend to stay multiply listed.

References

- Mayhew, Stewart, 1997, Option Market Microstructure and The economics of New Listings, Working Paper, Purdue University.