Gabby Hsin-Yo Wang and Dr. Michel J. Pinegar, Finance Professor, the Marriott School of Management

Insider trading has been a much-rumored phenomenon in Taiwan. In a newspaper article headlined Bitter Fruit of Stock Investment, the author states, “…Taiwan has a stock market culture which is — on the surface at least — quite egalitarian in its nature. Insider trading? Everyone is doing it.” Ironically, very little government action has been taken to track down insider traders, and the academia has been reluctant to search for evidence of insider trading in Taiwan in fear that such a sensitive research would result in serious ramifications.

This research intends to answer this question whether or not there is any evidence of insider trading. The raw data is collected from the website, www.sfi.org.tw/english, which contains categorized data of both listed companies on Taiwan Stock Exchange and on the over-thecounter (OTC) exchanges. Data is categorized by codes, as each code identifies a company. In order to retrieve the desired data, the user will need to select the functions (for example, market transaction or specific company transaction), enter the dates (ie, between a beg date and an end date), and then the website will return data that is available for retrieval. For this purpose, we simplify the sample by only retrieving data on the listed companies of Taiwan Stock Exchange and ignore the over-the-counter exchange stocks.

The sample structure is designed so that the high intensity month (AR-0) is preceded by previous six months of data and followed by six months of data afterwards. Two types of data are included in a sample: intensity and abnormal return. Intensity is defined as insiders’ shares traded divided by their total share holdings in a particular month. The AR-0’s insider trading intensity should always be equal or greater than 1% to be included in a sample. In other words, if a company’s insider trading intensity on a particular month is less than 1%, it is no t included as a sample. Abnormal return is calculated using company stock return for a particular month and then adjusted for market return.

The event is created from the raw data of a company’s insiders. When insider intensity is greater than 1% of total insider holdings, the data is called an event. Using this approach, it assumes that insiders will trade intensely (either buying or selling) when they have insider information (information only shared by specific shareholders of a company, thus, private information). In Taiwan, insiders are prohibited by law to trade on insider information.

There are 1117 buy events and 681 sell events. This tells us that insiders in Taiwan tend to have more intense buying activity than selling activity. In addition, a stronger conclusion can be drawn from the buy events than from sell events. The reason for that is because when stock is purchased, the investor does not want to conserve cash but rather would like to use it to invest, but when investor sells stock, it might mean the investor would like to conserve cash for a variety of reasons, the prospect of a stock is only one factor out of the many factors.

Time period ranges from January 1997 to June 2003. There are roughly 500 listed companies in the Taiwan Stock Exchange. Some data cannot be used because they do not have intense insider trading activity. The listed companies are categorized into 16 industries. The most traditional industries in Taiwan are concrete and steel. A few new industries became public during the economic boom of 1960s and 1970s in Taiwan; plastic and electronics are some of those industries during the economic boom. Today, the most important industry is electronics (mostly semi-conductor and computer parts) industry.

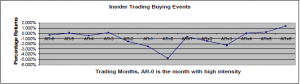

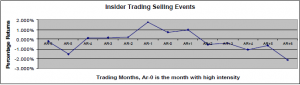

After the data is collected and analyzed, the researcher found that no statistical significant conclusion can be drawn as no t-stat is larger than one. One weakness in the data model is that because the data is monthly instead of daily, the analysis would not lead to very strong indication. However, a few interesting observations are made after the average of the abnormal returns are calculated. The buy events analysis shows that AR-0 is the month that has the lowest average abnormal return (-4.785%). In addition, the data pattern shows the abnormal return gradually decreases from AR-6 to the lowest point in AR-0, and then it increases again gradually to AR+0. However, the selling events show quite the opposite results (See figure 1 and 2).

When looking at the buying events by industries alone, the research reveals that out of the 16 industries included in the analysis, 14 of them have positive average abnormal returns in the month (AR+1) following AR-0. In other words, when a share holder purchases stock in AR-0, there is a very high likelihood that it will turn out to be a profitable return in the following month AR+1.

With the above two indications, we see that there is clearly evidence of insiders trading activity, which means insiders gain unusual abnormal returns consistently. An improvement can be made about this research if daily data instead of monthly data can be collected and analyzed. The lack of available daily data on the Taiwan Stock Exchange (TSE) website is a major hindrance for researchers and remains to be overcome by future researchers.