Terry Jackson and Dr. Ron Worsham, SOAIS

In the past year, a landmark Supreme Court decision changed the way restaurants calculate social security taxes related to employee tips. In the case of the United States v. Fior D’Italia, Inc. [2002-1 USTC ¶50,459], the Supreme Court ruled against Fior D’ Italia, Inc. by concluding that the IRS properly computed their social security tax liability, even though the IRS utilized a new “aggregate estimate” method. This new aggregate estimate method puts restaurants at risk of paying higher social security taxes. From examining data of restaurants in the Salt Lake area, there is no conclusive evidence that this ruling has affected restaurants negatively.

Understanding how the government raises revenue through taxes can be very difficult. It becomes even harder when dealing with wage earners that have income streams that are very hard to extrapolate. Compared to most wage earners, the wages earned by a restaurant employee can be hard to extrapolate. Since a substantial amount of wages earned by restaurant workers is attributable to gratuities, restaurant workers do not make a fixed rate of pay per hour. This is quite advantageous to a restaurant employee because they can outperform earnings based on their level of service compared to a fixed pay job. Unfortunately, wage earners like restaurant employees create headaches for the Internal Revenue Service (IRS). The IRS is responsible for collecting taxes for the treasury department in order to operate government.

Pursuant to §3101 and §3111 of the Internal Revenue Code (a compilation of statutes that govern taxation within the United States), a social security and hospital tax (known as FICA) is levied upon the wages paid with respect to employment. The FICA tax is calculated as a percentage of the wages paid to the employee with respect to employment. Generically, the term wages is defined by §3121(a) of the Internal Revenue Code as, “all remuneration for employment, including the cash value of all remuneration (including benefits) paid in any medium other than cash.” As stated earlier, restaurant employees create headaches for the IRS because of the variability of tips which according to §3121(a) is part of wages. In addition, it is hard for an employee to keep track of their total tips receipts and for the restaurant to monitor their employees because customers ask for cash back on tips recorded on their credit card receipts and tips can be paid in cash without any paper documentation of the tip received in cash. In the past, the IRS has allowed employers to keep track of total tip income by estimating each individual employee’s tip income separately, than adding individual estimates together to create a total. While using this method, the IRS has questioned whether this method for tip income truly gives an accurate total of the FICA tax that is owed by the restaurant to the government.

An example of the IRS’ scrutiny is found with San Francisco’s Fior D’Italia restaurant. In 1991 and 1992, the reports provided to Fior D’Italia by its employees showed that total tip income amounted to $247,181 and $220,845 in each year respectively. Based on these computed amounts, Fior D’Italia calculated and paid its FICA tax. The same reports, however, showed that customers had listed tips on their credit card slips amounting to far more than the amount reported by the employees ($364,786 in 1991 and $338,161 in 1992). Not surprisingly, this discrepancy led the IRS to conduct a compliance check. That check led the IRS to issue an assessment against Fior D’Italia for additional FICA tax. To calculate the added tax it found owing, the IRS used a new method known as the “aggregate estimation” method. The aggregate estimation method is calculated by finding the percentage that customers tipped on average on credit card receipts. Then this method assumes that cash-paying customers on average tipped at the same rates as credit card customers. Last, the IRS would calculate the total tips by multiplying the tip rates by the restaurant’s total receipts and subtract tips already reported and applied the FICA tax rate to the remainder. With respect to Fior D’Italia, the new aggregate estimation method resulted in total tips amounting to $403,726 and unreported tips amounting to $156,545 in 1991. The same figures for 1992 showed $368,374 and $147,529. The IRS issued an assessment against Fior D’Italia for additional FICA taxes owed, amo unting to $11,976 for 1991 and $11,286 for 1992.

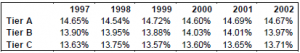

Now that the Supreme Court has ruled that the aggregate estimation method is a legitimate method in calculating an employer’s FICA tax liability, will FICA tax liabilities change for restaurants? Will restaurants have higher employer FICA tax liabilities because of the aggregate estimate method? To find out how the Fior D’Italia decision affected restaurants, I examined data of restaurants in Salt Lake City, Utah. I looked at their aggregate tips as a percentage of gross receipts to see if those figures in the past few years are smaller or greater than the percentages found this year. To maintain anonymity of the restaurants used in my research, I classified the restaurants into three tiers. The first tier (Tier C) consisted of restaurants with twoparty average bills under $20. The mid-tier restaurants (Tier B) consisted of restaurants with two-party average bills ranging from $20 to $50. The highest tier (Tier A) consisted of restaurants with two-party average bills greater than $50. After randomly selecting restaurants, I gathered information about these different tiers of restaurants for the past five years and 2002 (the year of the Fior D’ Italia decision). Below are my findings:

After examining my findings, I found there to be no correlation in the changes of the percentage of FICA taxes with respect to gross receipts since the Fior D’Italia Supreme Court decision. Unfortunately, only one year of tax information was available to compare since the decision. I believe that I can analyze data in future years (i.e. 2003, 2004, 2005) to get a better picture of whether the aggregate estimate method has resulted in restaurants recognizing more tip income as a percentage of gross receipts and thus paying more FICA taxes.

Since my data only included information about restaurants in Salt Lake City, restaurant data that includes a greater geographic region may show a difference in correlation. I believe that there has not been much change in the percentage of tip income with respect to gross receipts because restaurants are trying to do the best job they can at recognizing the income that is earned. The aggregate estimate method may only come into use with restaurants that have grossly understated gratuity income with respect to gross receipts.