Ben Lewis and Dr. Paul Godfrey, Organizational Leadership and Strategy

According to the World Bank, approximately 3 billion people, almost half of the earth’s inhabitants live in poverty (World Bank, 2008). Although substantial progress in the war against poverty has been made, the need for economic development is pressing and real. Over the past year, my mentor and I have sought to identify the role that corporations play in creating meaningful and sustainable economic around the world. In particular, we examine and define the ways that these multi-national companies can increase the level of institutional capital in their areas of operation.

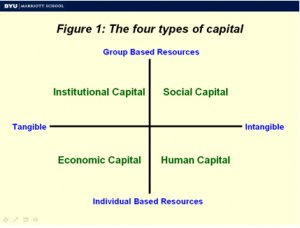

Institutional capital represents the sum-total of macro-social resources available to an individual. As shown in Figure 1 below (a model of self-reliance developed by Dr. Godfrey), institutional capital occupies the intersection of tangible and grouped-based resources. Traditionally, economists have measured institutional capital by examining the regulative role of institutions (e.g. rule of law, property rights, formal market mechanisms, etc.) and their effects on development. We add to this list physical elements such as miles of road, telephone or electronic infrastructure, and the underlying geography of a region or country. In summary, institutional capital captures the strength or weakness of the system in which a person lives.

Initially we sought to create an index so that the level of institutional capital of any particular individual could be measured at any given time. After months of research, we came to the conclusion that this area of research had been significantly developed and that our ability to extend this research frontier would be limited without advanced econometric training. Consequently, we refocused our efforts on defining the corporation’s role in economic development.

We hypothesize that corporations have two unique ways in which they can contribute to the economic development of the countries in which they operate: (1) Foreign Direct Investment (FDI) and (2) Corporate Philanthropy (CP). By establishing a business presence in developing countries and developing and enriching these countries, corporations will provide greater gains for the region and greater returns for the company.

This project is the first of a series of projects aimed toward identifying the corporate role in economic development. In this first phase , we seek to answer the following question: What types of FDI and philanthropic investments are companies currently making in developing countries?

To answer this question, we selected 12 companies from four unique sectors (Financial Services, Consumer Products, Energy, and Technology) and analyzed their latest Corporate Social Responsibility (CSR) and Annual Reports. Each of the twelve corporations is an industry leader and a member of the Committee to Encourage Corporate Philanthropy (CECP) which ensured that all companies in the sample had significant global operations and substantial philanthropic involvement.

Results for two of the twelve companies are shown in Table 1 below. In each of the twelve, we identified investment and/or philanthropic activities in each of the four areas of capital.

Our initial study reveals a wide variation among the number and types of investment and philanthropic activities engaged by the twelve corporations of interest. There also appears to be industry effects on the types of activities pursued i.e. each company invests in its own area of expertise.

In the coming months, we hope to expand our research on the role of corporations in economic development by addressing the following questions: (1) How do companies coordinate business and philanthropy? (2) Does greater involvement lead to higher levels of development within these countries? (3) What barriers to development exist that single companies seem unable to surmount?