David Wilson and James Brau, Finance

Our project sought to test traditional theories of capital structure (e.g., Ang & Peterson, 1986, Rajan & Zingales, 1995, Titman, & Wessels, 1988 DeAngelo & Masulis,1980, Leland, 1994, and Modigliani & Miller, 1958) through the analysis of a naturally occurring experiment produced among various transportation industry sectors (i.e. rail, truck, air, ship). The transportation industry is novel because the four types of transportation methods all have the same objective – to move product from one place to the other (Carter, Rogers, & Choi, 2015, and Gelsomino, Mangiaracina, Perego, & Tumino, 2016) – while each sector faces unique governmental regulation. Their similarity in purpose and inconsistency in constraint enables us to evaluate whether or not sector specific constraints have an effect on optimal financing decisions.

Our project presented unique challenges for us, such as the comparative monitoring of regulatory practices for each sector throughout time and the transformative nature of the availability and commonality of securities on a firm’s optimal financing decisions. These dilemmas, among others, required us to rely heavily on econometric models which have direct relevance among various corporate finance theories and models. The variety of these methods are extensive and a composite listing is not ideal in such a write-up. However, a complete list of models and econometric methods will be listed in the reference section.

Although each econometric approach is unique, they essentially ask two formidable questions. 1) Do governmental regulations have an effect on the optimal capital structure? and, 2) What effects if any, do the regulations have and why? Our analysis primarily focused on the first of these questions. We essentially test capital structure theories through the following approach: If governmental regulations or sector-specific constraints exist but have no effect on optimal financing decisions, we would expect their capital structures to be nearly identical. Therefore, if differences exist, it is likely due to the variance in regulation and sector-specific constraints.

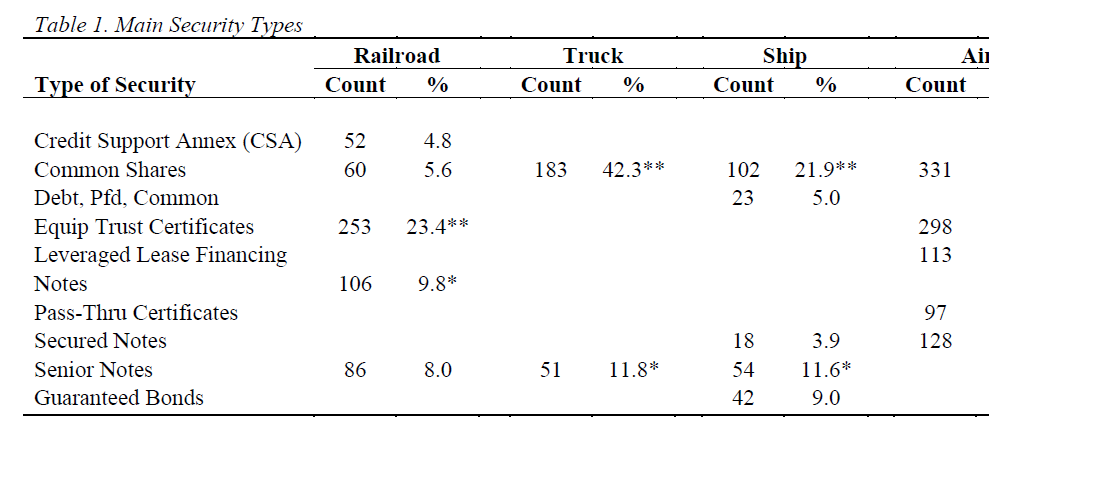

Using data from Thomson Financial’s SDC New Issues Database we evaluated 3,831 observations among the various sectors. We found that the Air and truck sectors had the highest and lowest number of observations respectively, likely due to the relative need for capital across these sectors. Because each sector uses thousands of various security types, we evaluate the first 50% of financing for each firm. That is, we look at how firms generate the initial majority of their capital. We found that the transportation industry as a whole primarily utilizes 10 types of securities across the four sectors. However, six of those security types are unique to individual sectors. We also found that Common Shares are the primary source of financing for truck, ship, and air, but not for railroads which derives its primary financing from Equip Trust Certificates, shown in the table 1 below.

Because we sought to perform a general evaluation of capital structure theories, our results are subsequently general. Across the board, we found little evidence for outright support or rejection of the various competing theories regarding the transformative effects of governmental regulation. On the aggregate, each sector is mostly similar in the majority of its financing decisions. Although unique financing choices exist among the various sectors, they tend to appear in the secondary sources of capital. However, we do find that Railroads are much more unique in their financing decisions which call to question the comparative impact of their regulations and constraints in contrast to the other sectors which seem to have similar outcomes.

Further analysis may yield stronger results. Steps such as generating variables which control for the nature and condition of financial markets as well as other economic factors which may have a strong impact on the financing decisions firms face. Additionally, we acknowledge our limitation in evaluating the causal relationships of thousands of interwoven regulatory constraints that uniquely affect each sector. The impact of regulations is complicated and difficult to understand individually, let alone in a dynamic collective environment, especially with our limited data set.

In conclusion, even though our results were limited to a generalized outlook on capital structure, we found significant differences among secondary financing decisions across all transportation sectors and primary financing decisions between railroad and other sectors. Our findings are unable to narrow down the direct causes of such differences due to the limited nature of our dataset, but have identified such limitations and have prescribed possible solutions. We, therefore, make no claims favoring one capital structure theory over another, but rather see our results as valuable preliminary findings which may be better expanded in the future.

References

Ang, J., Peterson, D., 1986. Optimal debt versus debt capacity: a disequilibrium model of corporate debt behavior. Research in Finance 6, 51–72.

Bradley, M., Jarrell, G.A. and Kim, E., 1984. On the existence of an optimal capital structure: Theory and evidence. The Journal of Finance, 39(3), 857-878.

Carter, C.R., Rogers, D.S. and Choi, T.Y., 2015. Toward the theory of the supply chain. Journal of Supply Chain Management, 51(2), 89-97.

DeAngelo, H. and Masulis, R.W., 1980. Optimal capital structure under corporate and personal taxation. Journal of Financial Economics, 8(1), 3-29.

Fisher, E., Heinkel, R., Zechner, J., 1989. Dynamic capital structure choice: theory and tests. Journal of Finance 44, 19–40.

Gelsomino, L.M., Mangiaracina, R., Perego, A. and Tumino, A., 2016. Supply chain finance: a literature review. International Journal of Physical Distribution & Logistics Management, 46(4), 348-366.

Graham, J., Leary, M., 2011. A review of empirical capital structure research and directions for the future. Annual Review of Financial Economics 3 (1), 309–345.

Harris, M. and Raviv, A., 1991. The theory of capital structure. the Journal of Finance, 46(1), 297-355.

Kestens, K., Van Cauwenberge, P., Christiaens, J., 2011. The effect of the notional interest deduction on the capital structure of Belgian SMEs. Environment and Planning C: Government and Policy 30 (2), 228–247.

Leland, H.E., 1994. Corporate debt value, bond covenants, and optimal capital structure. The Journal of Finance, 49(4), 1213-1252.

Modigliani, F., Miller, M., 1958. The cost of capital, corporation finance and the theory of investment. American Economic Review 48 (3), 261–297.

Myers, S.C., 1984. The capital structure puzzle. The Journal of Finance, 39(3), 574-592.

Panier, F., Perez-Gonzalez, F., Villanueva, P., 2013. Capital structure and taxes: what happens when you (also) subsidize equity?. Stanford University, Stanford, CA. Unpublished working paper.

Rajan, R.G. and Zingales, L., 1995. What do we know about capital structure? Some evidence from international data. The Journal of Finance, 50(5),1421-1460.

Titman, S. and Wessels, R., 1988. The determinants of capital structure choice. The Journal of Finance, 43(1), 1-19.