Lorien Stice and Dr. Ted Christensen, Accounting

Introduction and Description of Study

This research investigates investors’ perceptions of the expected impact of adopting international accounting standards on U.S. companies. Since these rules differ from current U.S. standards, some speculate that the costs to convert companies’ reporting systems to conform to international standards will have significantly negative effects on their profitability. My project explores stock price reactions to SEC announcements which indicate an increased or decreased probability that U.S. firms will soon be required to switch to International Financial Reporting Standards (IFRS). I hypothesize that expected conversion costs will be higher for companies that are not already operating in foreign countries because more diverse companies already have expertise with respect to international accounting standards. Therefore, I investigate the effects of firm diversification on how investors perceive the future effects of this likely change in accounting standards. I measure investors’ aggregate beliefs about the expected costs associated with conversion to IFRS by observing changes in stock prices.

Using stock returns data from the Center for Research in Security Prices (CRSP), firm accounting data from Compustat, and data on firm diversification generously provided by Scott Dyreng and Bradley Lindsey, I investigate the relation between firm diversification and stock price reactions on the dates adoption announcements are made. I estimate several regression models which measure investors’ perceptions of whether announcements about the adoption of IFRS are good or bad news for particular firms, using abnormal stock returns during the days surrounding each announcement as my dependant variable. In the first set of analyses, I explore only the days immediately surrounding the initial (positive) announcement indicating the nearly inevitable adoption of IFRS in the U.S. In the second set of analyses, I investigate abnormal stock returns on every day for every firm during the period in which these announcements were made. This approach dramatically increases the statistical power of my regression analyses. This method allows me to statistically contrast the days on which announcements related to IFRS adoption are made relative to normal “non-announcement” days.

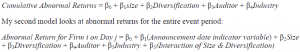

My explanatory and control variables proxy for factors I expect to be associated with the extent to which the conversion to international accounting standards is likely to affect firms’ profitability. Specifically, these variables are (1) firm diversification, (2) firm size, (3) auditor3, and (4) industry classification. The first model examines abnormal stock returns surrounding the SEC’s first public announcement indicating the likely convergence with IFRS:

In both of these models, I use several alternative specifications to explore whether the interaction between diversification and firm size is significantly associated with abnormal returns. In the second, I control for whether each announcement increases or decreases the likelihood of IFRS adoption. I hypothesize that larger, more diverse companies have higher abnormal stock returns on the days of announcements, especially those which increase the likelihood of adoption.

Results

The results for my first model suggest that, consistent with my expectations, firm size is positively associated with abnormal returns. However, inconsistent with my expectations, the results also suggest that diversification is negatively associated with abnormal stock returns. Further analyses of interactions between firm size and diversification reveal that this result is attributable to small, highly diverse firms. This suggests that smaller and more diverse firms are already overextended and additional mandatory accounting changes will result in excessive burdens for them. Although this model has a fairly low explanatory power, the R-square is typical of prior accounting research attempting to explain abnormal stock returns4. This market model still explains large dollar changes in returns and is therefore economically significant.

My second model reveals somewhat different results. This model indicates that announcements increasing the probability of IFRS adoption are negatively associated with market returns. However, more diverse firms experience stock price declines on days when announcements indicate that IFRS adoption is less likely. Although no firms have significantly positive returns when adoption appears to be imminent, announcements suggesting that IFRS may not be adopted appear to be a negative sign to investors about diverse firms. This result is consistent with the idea that these firms have already incurred significant costs to develop expertise for adoption and stand to benefit the most by conversion to a single (international) standard. Not adopting IFRS would mean that these preparations were simply additional costs, and that these firms will have to continue operating with some portions of their business reporting under U.S. standards and other reporting under IFRS. Failure to converge to a single set of standards would require these firms to continue maintaining two sets of records and expertise in order to report under both sets of standards.

Finally, I also investigate the volume of daily stock trades to explore how the SEC announcements affect the trading decisions of investors. Whereas stock price reflects average market beliefs about a company, trading volume measures disagreement among investors (Beaver, 1968). Generally, announcements that increase the likelihood of IFRS adoption are significantly positively associated with abnormal trading volume for less diverse firms, while announcements that decrease the likelihood of IFRS adoption are positively associated with abnormal trading volume for more diverse firms. This indicates that market participants believe that IFRS adoption is associated with the value of less diverse firms (which are not prepared for the switch). However, when the likelihood of IFRS adoption appears to be less likely, market participants trade more diverse firms’ shares because they expect that its price is not correctly valued.

Conclusion

Although not all of my results are consistent with my initial predictions, this project has been both beneficial and illuminating and has increased my understanding of accounting research as a whole. I will also have the opportunity to present my study and results at the Utah Conference on Undergraduate Research (UCUR) in February. Understanding some of the complex effects of this significant policy change in the U.S. is important as we decide if and when the transition to IFRS will take place. Based on my result, I believe the SEC has made a wise decision to ease into this change slowly, giving companies time to adapt.

References and Thanks

- I would like to thank Ted Christensen for his enormous help in the conception and execution of this project. His knowledge of accounting research and programming was an invaluable resource. Thanks also to Greg Burton, for contributing some of his vast knowledge of the SEC, and to James McDonald and Doug Prawitt, whose classes gave me the skills and motivation for the project.

- Armstrong et al.(2009) also used this control variable. They believed that a firm’s auditor could act as an indication (control) for audit quality of a firm. Firms with higher audit quality would have a different adjustment to the more lax rules of IFRS than those with low audit quality, and the market would impound this at the announcement date.

- For example, Armstrong et al. (2009) find an R-square of 3% in their model (compared to 5% in mine) explaining the effect of IFRS adoption on European firms in the early 2000’s.