Parker Rogers and Dr. Kerk Phillips, Economics Department

The purpose of this project was to model the implementation of a basic income guarantee, by repealing all existing government benefit programs and implementing a monthly lump sum transfer to all working individuals in the US economy; we repealed and implemented these policies using our model in order to observe the labor supply effects.

Economic inequality frequently dominates political rhetoric, particularly in regards to redistributive policy. One recently considered policy is the basic income guarantee. This policy repeals all existing government benefit programs and the implements a monthly lump sum payment to all working individuals. Some politicians, and tech companies, believe this policy could simplify our existing tax system, while providing a safety net for unskilled laborers in a world of technological innovation; however, many are concerned about the labor supply effects of a basic income guarantee.

Researchers have not conducted widespread studies on the potential effects of a basic income guarantee, due to the lack of data regarding this policy change (only a few small cases of this policy have ever been documented); thus, we provide a model that will predict the labor supply effects. Our research provides a richer pool of research from which lawmakers could draw.

Since our purpose was to observe the labor supply changes resulting from the implementation of a basic income guarantee, we calculated the current influence of existing government programs on the labor supply. To model these effects, we calculate the effective marginal tax rates (MTRs), or the amount that government benefits change due to an increase in wages, for many existing government benefit programs. These MTRs mitigate the benefits that individuals receive from working (Holt and Romich, 2007). After calculating these MTRs, we noticed that many of the existing government benefit programs already reduce the incentives to work for low-income individuals.

Calculating these MTRs was a difficult process. Many government programs are complicated and contain numerous eligibility requirements and income rules. Researchers generally calculate MTRs by creating a microsimulation model that incorporates the complex program rules; the MTR simulation is then run for a representative dataset of individuals. Instead of using this arduous method, I used a much quicker machine learning technique called Multi-Layer Perceptrons (Neural Nets), to predict MTRs.

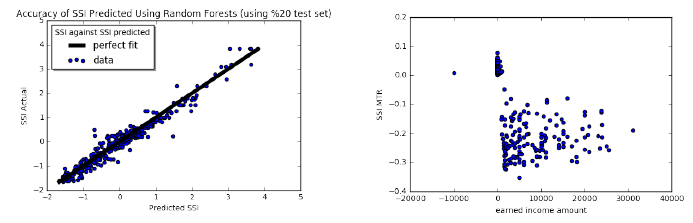

Neural nets can provide a flexible model of the complex relationships between many variables and can provide accurate predictions (Wager and Athey, 2015). As seen in the following graphs, by using Neural Nets I was able to predict the MTRs associated of the Supplemental Security Income program with astounding accuracy and simplicity.

Below we show the graph of the perfect fit line and a scatter plot of the MTRs calculated for each individual in the 2014 Current Population Survey using Neural Nets. The closer the dots are to the line, the better the prediction. The Neural Nets predicted the SSI benefit amounts with a 95% accuracy. Moreover, the marginal tax rates in the graph on the right are on par with what they should be theoretically.

Using Neural Nets in this unprecedented way, I was able to effectively calculated the MTRs associated with the SSI program, and I plan on publishing these findings.

I have also built a Social Security benefit calculator that calculates Social Security benefits from an individual’s earnings history, and from this, I have successfully calculated the marginal tax rates of the Social Security Program. Interestingly, this program has substantial re-distributive effects, since lower income individuals receive much higher marginal benefits from this program than wealthy individuals.

We will continue to expand this model to include many other government programs in order to accurately gauge how current government benefit programs influence our choices to work, so that we can more fully measure the effect of a repeal of all these programs, and the implementation of a basic income guarantee.