Justin Gardiner and Richard Evans, Department of Economics

Introduction

Many macroeconomic models have trouble matching the high end of the distribution of wealth in the economy. To correct this problem, we set out to build a model that includes individual agents experiencing stochastic changes to their income levels. These stochastic changes thus model real life risk and encourage precautionary saving. We built the theoretical framework for a large scale macroeconomic model in which individuals take into consideration the possible variability of their future income and alter their saving behaviors accordingly. We have made significant progress in creating a computer program that will allow us to calibrate our model to the US economy, simulate it, and analyze the results.

Methodology

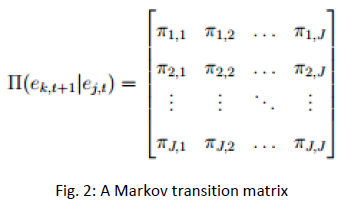

To build this model we used an overlapping generations model. It is so called because it consists of agents of different ages (generations) living life from birth to death. This is an important feature because at different ages individuals make different lifetime decisions. In this model that we created each agent is also endowed with a different ability level that, along with other forces in the labor market, determines the agent’s income each period. The ability level for each individual in the model is determined period by period through a stochastic process. This stochastic process is a very important part of this project which draws on work that Professor Evans had done previously in which a Markov chain was carefully calibrated to match the actual earnings process that occurs in the economy (DeBacker et al., Oct. 2015). The computer program that was created to calibrate and simulate this model was written in the Python Programming Language using mathematical techniques including constrained and unconstrained optimization routines and dynamic programming.

Results

The main result we have obtained is a computer program that will solve for the steady state of the economic model. The steady state is a fixed point of the function that transitions the economy from one period to the next in the state space of our model economy. Determining this steady state is an important step to eventually simulating the actual US economy.

Because of the heterogeneity of the agents and the randomness inherent in our model, we were not able to solve for the state space in the typical way, thus we were led to use and derive innovative solution methods which are a bit in depth and cannot be fully explained in two pages.

Also, this computer program, after finding the steady state of the model, is used to simulate the path the model economy would go given a starting state. However, this part of the computer program is still under the final stages of development. It, too, was not able to be solve by typical methods.

Discussion and Conclusion

It is well documented that wealth inequality has been steadily increasing in developed nations (Piketty, 2014). The fact that much of the wealth in the economy is held in the hands of a small percentage of the population has important macroeconomic implications but is not very well modeled by most macroeconomic models (De Nardi, 2015).

Many models set a deterministic income path for individuals that attempts to match the data, but when an agent knows his future income he does not take the precautionary savings against the risk of income shocks that is seen in the data and is theorized to exist.

We have not yet been able to show that our model corrects this problem because our computer program is not yet completed. However, what we have been able to accomplish is promising.

Sources

DeBacker, Jason, Richard W. Evans, Evan Magnusson, Kerk L. Phillips, Shanthi Ramnath, and Isaac Swift, “The Distributional Effects of Redistributional Tax Policy,” Under review, September 2015

DeBacker, Jason, Richard W. Evans, Kerk L. Phillips, and Shanthi Ramnath, “Estimating the Hourly Earnings Processes of Top Earners,” working paper, October 2015.

De Nardi, Mariacristina, “Quantitative Models of Wealth Inequality: A Survey,” NBER Working Paper

No. 21106, National Bureau of Economic Research April 2015.

Piketty, Thomas, Capital in the Twenty-First Century, Harvard University Press, 2014