Aaron Gifford and Dr. Joel Selway, Department of Political Science

Overview

For the last three years, the world has seen dramatic changes in the global economy. What began as a local failure of a couple banks and the deterioration of innovative financial products in the U.S. soon spread to other nations around the world. While most countries have had to suffer these wide-spread effects, some have been able to adapt to economic problems more easily and quickly than others, successfully leading their country out of financial distress. The major contributors to this success have largely been government-related. Swift financial intervention and robust economic legislation have helped these nations recover faster than those that followed other courses of action.

Hypothesis

We believe that this agility is mostly attributable to the structure of government regimes within these countries, namely the efficiency of legislative bodies and the stability and quality of government branches and agencies. In this study, we explored the relationship between the structure of government in emerging and developing economies and their financial market performance as it relates to their respective currency exchange rates. We believe that the more efficient and effective a government is in proposing and enacting sound legislation, the more the country will attract foreign capital, thus leading to an appreciation of its currency.

Methodology

In order to analyze this relationship, we decided to utilize regression analysis between global currency exchange rates with the U.S. dollar as the base currency (Euromonitor, 2010) and the following metrics that serve as our independent variables:

- Political Constraints: A metric that looks at the number of independent veto players over policy outcomes and the distribution of preferences of those players (Henisz, 2002). Low levels of political constraints are important in obtaining efficiency within government.

- Bureaucracy Quality: A measurement of the strength to govern notwithstanding drastic changes in policy or interruptions in government services (The PRS Group, 2010). This metric is important for countries that traditionally suffer from high levels of political instability.

- Government Stability: A metric that measures both a government’s ability to carry out its declared programs and its ability to stay in office. It’s comprised of the following subgroups: government unity, legislative strength, and popular support (The PRS Group, 2010).

Because many countries tightly control their currencies via pegs or currency boards, we selected to do our analysis only with those countries that have independently floating currencies (IMF, 2008). We also eliminated countries that are part of the European Economic and Monetary Union as it is difficult to analyze each country independent of the single currency. These two elimination factors left us with 21 currencies to analyze.

Project Outcome

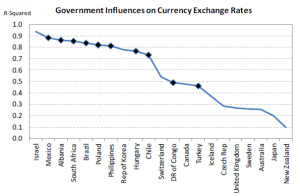

After running regressions across these variables, we found that the structure of government does in fact play a role in explaining currency movements within these countries. When looking at Israel, for example, we see that our independent variables explain 94% of the country’s currency movements over our period of analysis (1984 to 2007) with efficiency and bureaucracy quality being the significant factors. While we did find that 7 out of 21 of our countries enjoyed a relationship to these variables of 80% or more, we found that 6 had a relationship less than 30%.

The most interesting finding that we identified has to do with the dichotomy between emerging and developed economies and how the structure of government affects their currency markets differently. For example, when we rank our sample size in descending order according to the currencies that have the highest relationship (i.e. R-squared) to our independent variables, we see that the top third of our sample except Israel are all emerging markets (note the black diamonds in the figure above). On the other hand, the entire bottom third is comprised of developed countries such as Australia, Japan, and New Zealand. While we originally thought there would be a positive correlation between our variables and exchange rates, we found that we can only see a greater relationship between the structure of government and exchange rates in emerging economies, countries that normally have lower levels of government quality and stability and higher political constraints.

Conclusion

Taking into account all of these factors, we find that although the correlation between the structure of government and currency exchange rates isn’t necessarily significant for all countries in the aggregate, we can see an overall trend of the effect that government has on the financial markets in emerging economies. And while the structure does explain to an extent the movement of currencies in developed economies, the effect is much smaller.

References

- Euromonitor International. 2010. Exchange Rates Against U.S. Dollar: International Monetary Fund (IMF)/Euromonitor International Research. Data set used for currency exchange rates.

- Henisz, W. J. 2002. “The Institutional Environment for Infrastructure Investment.” Industrial and Corporate Change 11(2): Forthcoming. Data set used for political constraints.

- International Monetary Fund. 2008. De Facto Classification of Exchange Rate Regimes and Monetary Policy Frameworks. https://www.imf.org/external/np/mfd/er/2008/eng/0408.htm.

- The PRS Group. 2010. International Country Risk Guide. Data set used for bureaucracy quality and government stability data sets.