Todd M. Yost and Dr. Steven Thorley, Marriott School of Business Management

The original hypothesis behind this study was that the stock market would overreact to news events. So when positive news about a specific company develops the stock price would increase more than would be rational. Conversely when the news was negative the price would decrease more than is warranted. To test the hypothesis, I took several trials consisting of the best and worst performers from the New York Stock Exchange (NYSE) and the Nasdaq stock exchange. I then followed the stock prices for several weeks to see if the price adjusts to reflect the real value of the information.

After several trials totaling 100 different stocks, I must report that the information leads me to believe that my hypothesis is wrong. However, the data seems to show another interesting conclusion, the market appears to be overly optimistic. If positive news about a company develops, the stock price seems to increase too much. As my data shows, this initial positive move is usually followed by a decline in price (the NYSE portfolio fell by 9.66% , and the Nasdaq by 13.10% ) . However, when bad news comes forward, the stock price moves sharply downward, but the evidence suggests that it doesn’t decrease enough. Since most stocks I studied seem to continue to fall in price for weeks after the original news was announced (the NYSE portfolio fell by 9.15% , the overall Nasdaq portfolio, however; gained ground by 6.69%, due to large returns by only three stocks).

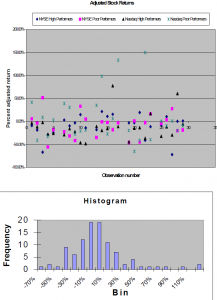

There were of course exceptions, in fact three stocks from the Nasdaq market, after posting a huge decrease in value rebounded and doubled in value over the next five weeks. Unfortunately the average stock did not do as well. The accompanying graph shows the percentage results after adjusting for movements by the entire stock market. The labels on the graph show which market the stock came from (NYSE or Nasdaq) and whether the initial stock movement was positive (high performer) or whether the movement was negative (poor performer).

The next figure is a histogram of the stock returns. The distribution of the returns resembles a statistical normal distribution. However, the actual mean return is -6.3%, compared to an expected mean of 0.00%. Showing that the stocks, on average, underperformed their indexes by a healthy margin.

This leads me to conclude that the market is overly optimistic. It would seem that participants put a good light on bad news, and an even better light on good news.

This conclusion leads to several interesting implications. First is the possibility of obtaining unusually high profits in the stock market by shorting both the best and worst performing stocks and using the proceeds to buy an index fund. If the research holds true, then the index portfolio will do better than the portfolio of shorted stocks, thereby giving the investor a high return. Another implication could be that the entire market is optimistic simply because it is currently a bull market. And therefore the results would be either reversed or unpredictable if and when the overall stock market becomes a bear market.